Your Flower mound property tax rate images are available. Flower mound property tax rate are a topic that is being searched for and liked by netizens now. You can Find and Download the Flower mound property tax rate files here. Download all royalty-free vectors.

If you’re searching for flower mound property tax rate pictures information linked to the flower mound property tax rate interest, you have visit the ideal site. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

Flower Mound Property Tax Rate. Flower Mound Town Council approves decrease in property tax rate. 7 budget workshop. Tarrant County - Home Tax Assessor-Collector Property Tax 2021 Tax Rate Calculation Worksheets. 179 rows Highland Park which has a combined total rate of 167 percent has the lowest.

How Much Does It Cost To File A Quit Claim Deed In Texas Rates Vary By State And Law Office But Typically Fall In The Ra Quitclaim Deed Law Office Marketing From pinterest.com

How Much Does It Cost To File A Quit Claim Deed In Texas Rates Vary By State And Law Office But Typically Fall In The Ra Quitclaim Deed Law Office Marketing From pinterest.com

In our calculator we take your home value and multiply that by your countys effective property tax rate. Blue Mound City Updated September 20 2021. Denton County Property Tax Payments Annual Denton County Texas. Income Taxes. The IS rate will remain at its current rate of 03809. See reviews photos directions phone numbers and more for Property Tax Rate locations in Flower Mound TX.

The proposed budget includes decreasing the property tax rate to 0405000 per 100 valuation a 722 reduction from the current property tax rate.

One of the fantastic things about living in Texas is the absence of a state income tax. Properties in the Town are appraised by the Denton CAD and Tarrant CAD. That being said Texas does fund many of their infrastructure projects etc. The Flower Mound Town Council will hold a public hearing on the proposed property tax rate during the Sept. See reviews photos directions phone numbers and more for Property Tax Rate locations in Flower Mound TX. Southside Place which has a combined total rate of 194 percent has the lowest property tax rate in the Houston area and Galena Park with a combined total rate.

Source: pinterest.com

Source: pinterest.com

Southside Place which has a combined total rate of 194 percent has the lowest property tax rate in the Houston area and Galena Park with a combined total rate. Flower Mound offers a senior citizen rate ages 65 of 1285 plus tax per month for trash and recycling services. Flower Mound homeowners will also get an extra tax break in the coming year with the Town Councils vote in June to double the. Commissioners also approved an increase to the property tax rate which will be 0233086 per 100 assessed value. That being said Texas does fund many of their infrastructure projects etc.

The town council has already approved an increased homestead exemption from 25 to 5. Blue Mound City Updated September 20 2021. The new property tax rate will be 04050 per 100 valuation. Denton County Property Tax Payments Annual Denton County Texas. Town of Flower Mound Attached are the following documents.

Source: collincountytx.gov

Source: collincountytx.gov

7 budget workshop. 3700 River Walk Drive 295 Flower Mound TX 75028. The Flower Mound Town Council will hold a public hearing on the proposed property tax rate during the Sept. The Flower Mound Town Council on Monday voted unanimously to approve the towns new budget and to reduce the property tax rate by 722. Flower Mound homeowners will also get an extra tax break in the coming year with the Town Councils vote in June to double the.

Source: communityimpact.com

Source: communityimpact.com

Blue Mound City Updated September 20 2021. No New Revenue and Voter Approval Tax Rate Worksheets Tax Rate Recap Notice of Tax Rates required to be posted on taxing unit website Approving No New Revenue Rate of 0422069100 Voter Approval Rate of 0419471100. The Flower Mound Town Council will hold a public hearing on the proposed property tax rate during Mondays council meeting. 21 Town Council meeting at. Flower Mound offers a senior citizen rate ages 65 of 1285 plus tax per month for trash and recycling services.

Source: texasscorecard.com

Source: texasscorecard.com

The current Flower Mound city property tax rate is 0439000 per 100 valuation. Charges assessed for trash pick up are based on the use of. 3700 River Walk Drive 295 Flower Mound TX 75028. The Flower Mound Town Council will hold a public hearing on the proposed property tax rate during Mondays council meeting. No New Revenue and Voter Approval Tax Rate Worksheets Tax Rate Recap Notice of Tax Rates required to be posted on taxing unit website Approving No New Revenue Rate of 0422069100 Voter Approval Rate of 0419471100.

Source: id.pinterest.com

Source: id.pinterest.com

FWSD 7s property tax rate dropped from 86 to 80 cents per 100 of valuation. The town council has already approved an increased homestead exemption from 25 to 5. Commissioners also approved an increase to the property tax rate which will be 0233086 per 100 assessed value. No New Revenue and Voter Approval Tax Rate Worksheets Tax Rate Recap Notice of Tax Rates required to be posted on taxing unit website Approving No New Revenue Rate of 0422069100 Voter Approval Rate of 0419471100. Denton County Property Tax Payments Annual Denton County Texas.

Source: pinterest.com

Source: pinterest.com

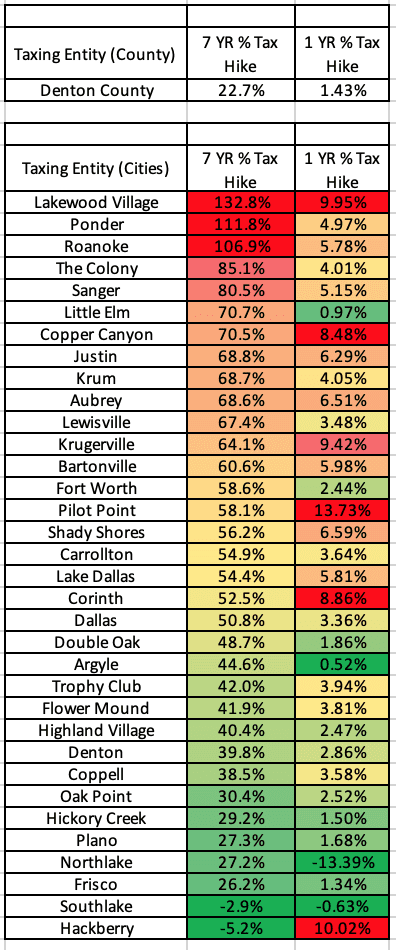

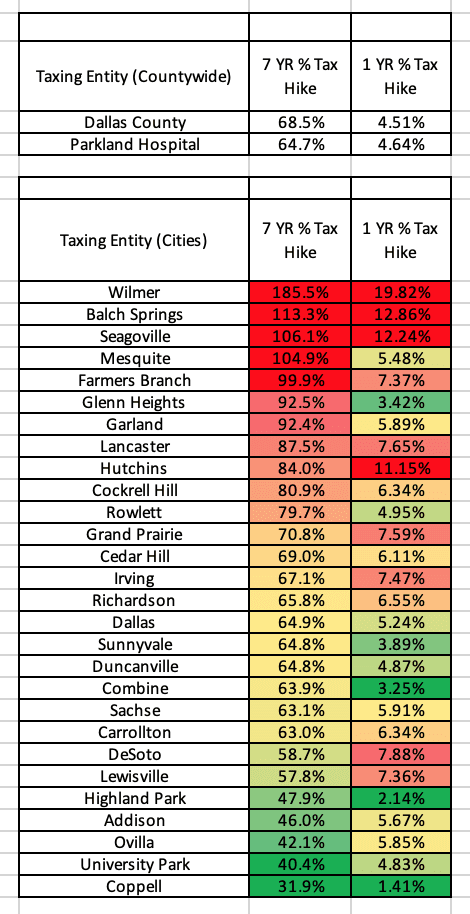

The Flower Mound Town Council will hold a public hearing on the proposed property tax rate during the Sept. Properties in the Town are appraised by the Denton CAD and Tarrant CAD. Property Tax Rate Comparisons around North Texas. 179 rows Highland Park which has a combined total rate of 167 percent has the lowest. Trash and Recycling services are provided for 1448 plus tax per month.

Source: texasscorecard.com

Source: texasscorecard.com

The towns property tax rate is currently 04365 per 100 valuation. FWSD 6s rate was reduced from 82 to 79 cents. Town of Flower Mound Attached are the following documents. There are typically multiple rates in a given area because your state county local schools and emergency responders each receive funding partly through these taxes. This brings the combined new property tax rate to 13087 per 100 assessed valuation a decrease of 00386.

Source: communityimpact.com

Source: communityimpact.com

One of the fantastic things about living in Texas is the absence of a state income tax. 21 Town Council meeting at. The current Flower Mound city property tax rate is 0439000 per 100 valuation. The proposed budget includes decreasing the property tax rate to 0405000 per 100 valuation a 722 reduction from the current property tax rate. Notice of 2021 Tax Year Proposed Property Tax Rate FY 2021-2022 Tax Notice Property Tax Information All real and personal property in the State of Texas is subject to ad valorem property taxes and is appraised by central appraisal districts CAD which are typically located within each county in the state.

Source: pinterest.com

Source: pinterest.com

000 The total of all income taxes for an area including state county and local taxes. This brings the combined new property tax rate to 13087 per 100 assessed valuation a decrease of 00386. Median Property Taxes No Mortgage 4021. The Flower Mound Town Council on Monday voted unanimously to approve the towns new budget and to reduce the property tax rate by 722. Please note that we can only estimate your property tax based on median property taxes in your area.

Source: de.pinterest.com

Source: de.pinterest.com

This is quite appealing to those relocating from many other states around the nation. Tarrant County - Home Tax Assessor-Collector Property Tax 2021 Tax Rate Calculation Worksheets. That being said Texas does fund many of their infrastructure projects etc. SB2 has diminished the towns independent legal ability to. The proposed budget includes decreasing the property tax rate to 0405000 per 100 valuation a 722 reduction from the current property tax rate.

Source: pinterest.com

Source: pinterest.com

Commissioners also approved an increase to the property tax rate which will be 0233086 per 100 assessed value. Flower Mounds fiscal 2020 tax rate of 0439 per 100 of TAV provides ample capacity below the 250 per 100 TAV cap for operations and limited tax debt service. Council direction on the proposed budget of 99997327 and proposal to maintain the current property tax rate of 04433 per 100 valuation were approved by council at the Aug. Commissioners also approved an increase to the property tax rate which will be 0233086 per 100 assessed value. Property Tax Rate Comparisons around North Texas.

Source: communityimpact.com

Source: communityimpact.com

21 Town Council meeting at. Charges assessed for trash pick up are based on the use of. This is quite appealing to those relocating from many other states around the nation. Southside Place which has a combined total rate of 194 percent has the lowest property tax rate in the Houston area and Galena Park with a combined total rate. Flower Mound Town Council approves decrease in property tax rate.

Source: pinterest.com

Source: pinterest.com

Trash and Recycling services are provided for 1448 plus tax per month. Property Tax Rate. Trash and Recycling services are provided for 1448 plus tax per month. 2021 Tax Rate Calculation Notice Taxing Unit Name. No New Revenue and Voter Approval Tax Rate Worksheets Tax Rate Recap Notice of Tax Rates required to be posted on taxing unit website Approving No New Revenue Rate of 0422069100 Voter Approval Rate of 0419471100.

Source: texasscorecard.com

Source: texasscorecard.com

Luckily North Texas. 7 budget workshop. Denton County Property Tax Payments Annual Denton County Texas. On a 400000 house in Lantana the new tax rates mean a savings. The proposed budget includes decreasing the property tax rate to 0405000 per 100 valuation a 722 reduction from the current property tax rate.

The proposed budget includes decreasing the property tax rate to 0405000 per 100 valuation a 722 reduction from the current property tax rate. 2021 Tax Rate Calculation Notice Taxing Unit Name. 21 Town Council meeting at. FWSD 6s rate was reduced from 82 to 79 cents. Flower Mound homeowners will also get an extra tax break in the coming year with the Town Councils vote in June to double the.

Source: collincountytx.gov

Source: collincountytx.gov

FWSD 6s rate was reduced from 82 to 79 cents. The proposed budget includes decreasing the property tax rate to 0405000 per 100 valuation a 722 reduction from the current property tax rate. Notice of 2021 Tax Year Proposed Property Tax Rate FY 2021-2022 Tax Notice Property Tax Information All real and personal property in the State of Texas is subject to ad valorem property taxes and is appraised by central appraisal districts CAD which are typically located within each county in the state. This is quite appealing to those relocating from many other states around the nation. Properties in the Town are appraised by the Denton CAD and Tarrant CAD.

Source: pinterest.com

Source: pinterest.com

Properties in the Town are appraised by the Denton CAD and Tarrant CAD. Flower Mounds fiscal 2020 tax rate of 0439 per 100 of TAV provides ample capacity below the 250 per 100 TAV cap for operations and limited tax debt service. Income Taxes. Charges assessed for trash pick up are based on the use of. Luckily North Texas.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title flower mound property tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.